Linking Aadhar and PAN is not mandatory for all

By Vkeel Team

In the Income Tax Department, adding your nomination permanent account number (PAN) with Aadhaar number has been made compulsory from July 1, but this is not necessary for everyone. The government has given exemption to certain sections of the country by doing so with certain conditions.

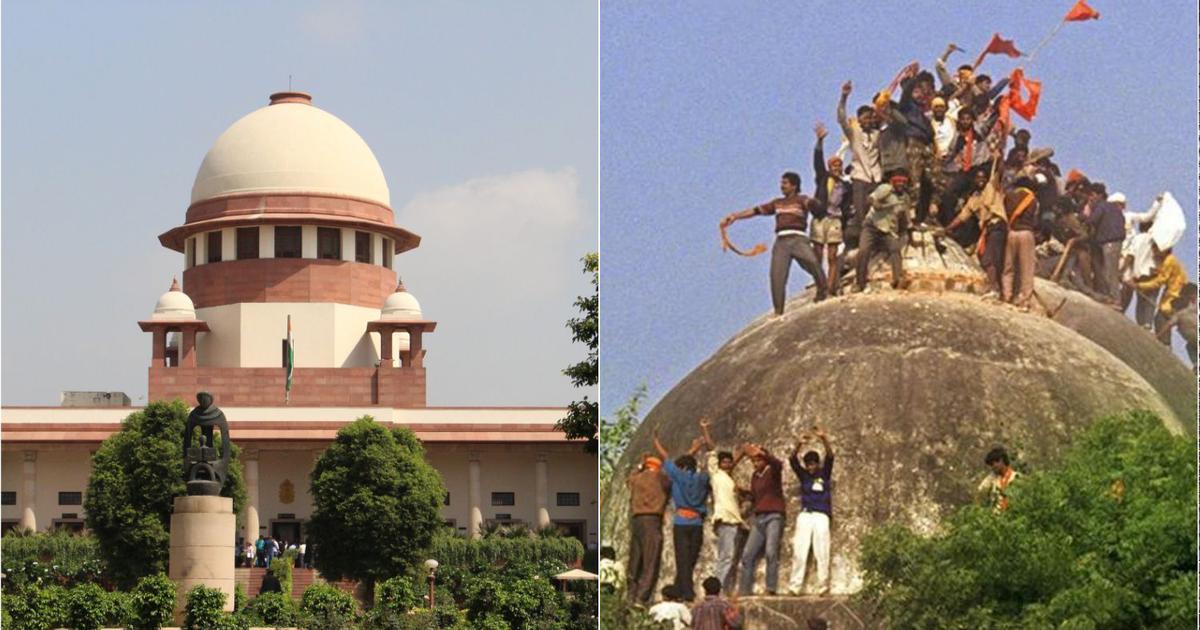

Earlier, the Supreme Court had declared the Section 139AA valid. The Central Board of Direct Taxes (CBDT) in its notification issued on May 11, 2017 had clarified that those who have been exempted from the mandatory add-on to their PAN have been excluded from the purview of Section 139AA of the Income Tax Act.

The CBDT said in its notification that Section 139AA of the Income Tax Act does not apply to the following:

- People classified as non-resident Indians according to income tax law.

- Those who are not citizens of India.

- If someone is 80 years of age or older during the tax year

- Residents of Assam, Meghalaya and Jammu and Kashmir states.

New Section 139AA of the Income Tax Act states that till 1 July 2017, every person who has been PAN-allotted and who is eligible to receive the Aadhaar number, tax authorities will have to give information about it. If you do not add your PAN to the base then it may also be invalid, although the last date for doing so has not yet been announced by the government.

Linking Aadhar

Disclaimer:

The information provided in the article is for general informational purposes only, and is not intended to constitute legal advice or to be relied upon as a substitute for legal advice. Furthermore, any information contained in the article is not guaranteed to be current, complete or accurate. If you require legal advice or representation, you should contact an attorney or law firm directly. We are not responsible for any damages resulting from any reliance on the content of this website.